Understanding payment processing fees

Payment processing fees for restaurants are typically far higher than they appear due to hidden charges that payment processors deliberately obscure across multiple statement sections. Whilst providers advertise attractive rates like 0.5%, the true cost often reaches 1.9% to 2.0% once you factor in interchange and scheme fees, authorisation fees, monthly card reader rentals (often £23 or more), and PCI DSS compliance charges.

These hidden costs can turn what appears to be £36 in fees into over £80 in actual charges on a £4,359 GMV. Payment processors use this obfuscation strategy intentionally, separating charges to make it difficult for busy restaurant owners to understand their real costs. Flipdish offers transparent pricing at 1.4% + 10p with no hidden fees, alongside integrated payments, real-time profit and loss management, customer data ownership, and an excellent support team rated highly on Trustpilot and Capterra. The platform helps restaurants avoid fee surprises, reduce reconciliation work, minimise errors, and maintain clear visibility of all business costs in one system.

Restaurant owner? Think you’ve got a great deal for your on-premises payment processing? Think again.

Today, it’s so important to know where you actually stand, financially. And while third-party fees may seem low, there are usually a bunch of additional costs hiding away, often listed separately from your statement.

Restaurant owner? Think you've got a great deal for your on-premises payment processing? Think again.

Table of contents

- The hidden truth behind processing fees

- What you see versus what you pay

- The hidden fees eating your profits

- The real cost breakdown

- Why are these fees hidden?

- There's a better way

- The Flipdish difference

- Take action today

Today, it's so important to know where you actually stand financially. And whilst third-party fees may seem low, there are usually a bunch of additional costs hiding away, often listed separately from your statement.

The hidden truth behind processing fees

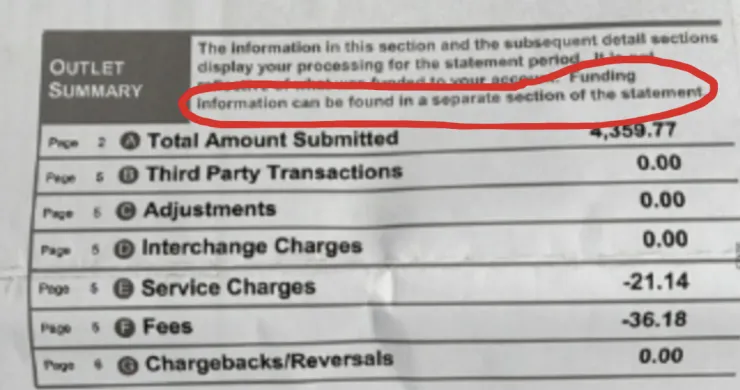

Let's take a closer look at a typical payment processing statement. At first glance, the fees might look reasonable: less than 0.5% for a GMV (Gross Merchandise Volume) of £4,359. But there are additional charges that aren't always visible.

These hidden charges "can be found in a separate section of the statement". Why? Well, basically, because the issuer wants to obscure things. They'd much rather you pay attention to the 0.5% figure whilst they sneakily tack on more costs, like the monthly £23 card reader fee, in addition to other possible extras.

That 0.5% figure? It's just the Acquirer Fee. It's the tip of the iceberg, and there's a whole mountain of additional costs lurking beneath the surface.

What you see versus what you pay

Payment processors are experts at making their fees appear minimal. They'll prominently display that attractive low percentage rate, but conveniently separate out all the other charges that significantly increase your actual costs.

The advertised rate might show:

- GMV: £4,359.00

- Advertised Rate: 0.5%

- Visible Fees: £36.00

This looks reasonable, right? Wrong.

The hidden fees eating your profits

The hidden extra costs you may not be aware you're being charged for include:

Interchange and Scheme Fees: Fees charged by the card brands (e.g. Visa, Mastercard) to cover the costs of providing their payment network. These vary based on card type and can be substantial.

Authorisation Fees: A charge for authorising the transaction with the issuing bank on each sale. This applies to every single transaction, no matter how small.

Monthly Card Reader/Terminal Rental Fees: A fixed fee for renting out your card machine. In many cases, that's an additional £23 per month, which many businesses overlook when calculating their true processing costs.

PCI DSS Monthly Fees (Payment Card Industry Data Security Standard): A fee to cover the cost of ensuring payments are PCI compliant. Another charge that's often tucked away in the fine print.

The real cost breakdown

Whilst each of these fees may look small individually, when you add them all together, the true picture emerges:

The actual cost breakdown:

- GMV: £4,359.00

- Acquirer Fee (0.5%): £21.80

- Interchange & Scheme Fees: £30.00

- Authorisation Fees: £8.50

- Card Reader Rental: £23.00

- PCI DSS Compliance: £5.00

Total Charges: £88.30 (approximately 2.0%)

That seemingly attractive 0.5% rate suddenly becomes closer to 1.9% to 2.0%, and those "fees" of £36 creep up to total charges of over £80.

All these sly little extras really add up over time. Not great if you're trying to keep a tight focus on your margins.

Still think you've got a good deal?

Why are these fees hidden?

Payment processors have become masters at fee obfuscation. By separating charges across multiple sections of your statement, they make it incredibly difficult to understand your true costs at a glance. This isn't accidental; it's by design.

The strategy is simple: draw your attention to one appealingly low number whilst the real costs hide in plain sight across various line items and statement sections. Many busy restaurant owners simply don't have the time to piece together the full picture, and that's exactly what these companies are counting on.

Now more than ever, it's vital for businesses to be able to clearly manage their profit and loss and see exactly where their money is being spent, without having to account for any hidden extras or play detective with their statements.

There's a better way

At Flipdish, we believe in being transparent and upfront because we're food industry natives. We've worked in kitchens, we've run restaurants and takeaways, and we know how hard it can be.

We understand the pressure of tight margins, the complexity of managing multiple costs, and the frustration of discovering hidden fees that eat into your profits. That's why we've built a solution that's honest, straightforward, and designed specifically for businesses like yours.

The Flipdish difference

Our in-store processing fee isn't hidden. It actually works out at slightly less than in the above example at 1.4% + 10p. That's it. No surprises, no hidden charges tucked away in separate sections of your statement.

What you get with Flipdish:

Not only do you get a more competitive rate and complete transparency, but you also receive a superb POS that helps you track your actual running costs in real time. But that's just the beginning. With Flipdish, you also benefit from:

- Ownership of all your customer data: Build your business on your terms, not someone else's platform. Your customer relationships belong to you.

- Integrated payments: Everything works together seamlessly, eliminating the hassle of juggling multiple systems and providers.

- Fewer reconciliations: Spend less time matching payments to orders and more time running your business.

- Fewer errors: Integrated systems mean fewer opportunities for mistakes that cost you time and money.

- Quicker processing: Get your money faster with efficient payment processing that doesn't leave you waiting.

- Real-time profit and loss management: See exactly where you stand financially at any moment, with clear, transparent reporting that actually makes sense.

- Straightforward tools to grow: Including a branded mobile app and website that help you build direct relationships with customers and reduce reliance on expensive third-party platforms.

- An excellent customer support team: Literally. We're rated 'Excellent' by Trustpilot and Capterra customers.

Transparency you can trust:

When you work with Flipdish, you'll never have to hunt through multiple statement sections to understand your true costs. Everything is clear, upfront, and honest. You'll know exactly what you're paying and why, allowing you to make informed decisions about your business.

This transparency extends beyond just payment processing. Our entire platform is built on the principle that you deserve to understand and control every aspect of your business costs. No tricks, no hidden fees, no surprises.

Take action today

Don't let hidden fees continue to erode your profit margins. It's time to take control of your payment processing costs and see the full picture. Set up a quick chat with us today and we'll show you how Flipdish can make your life easier and your business more profitable.

Join thousands of restaurants that have already made the switch to transparent, honest payment processing.

FAQs

The most common hidden fees include interchange and scheme fees (charged by card brands like Visa and Mastercard), authorisation fees (applied to every single transaction for verifying with the issuing bank), monthly card reader or terminal rental fees (often £20-£30 per month), and PCI DSS compliance fees (for payment security standards). These charges are typically listed in separate sections of your statement, away from the prominently displayed percentage rate.

Whilst individually they may seem small, collectively they can more than triple your actual processing costs. For example, an advertised 0.5% rate can actually cost you closer to 2.0% once all hidden fees are included, turning what looks like £36 in fees into over £80 on a £4,359 transaction volume.

To calculate your true payment processing costs, you need to gather all charges from every section of your payment processing statements, not just the main percentage rate. Start by identifying your total monthly GMV (Gross Merchandise Volume), then list out every single fee: acquirer fees, interchange fees, scheme fees, authorisation fees, terminal rental charges, PCI compliance fees, and any other monthly or per-transaction charges.

Add all these together and divide by your GMV to get your actual percentage cost. Many restaurant owners are shocked to discover their "0.5%" rate is actually 1.8% to 2.2% when properly calculated. Request a fully itemised statement from your current provider and compare the total charges against what you thought you were paying. This exercise often reveals hundreds of pounds in hidden costs each month.